reverse sales tax calculator nj

That entry would be 0775 for the percentage. Average Local State Sales Tax.

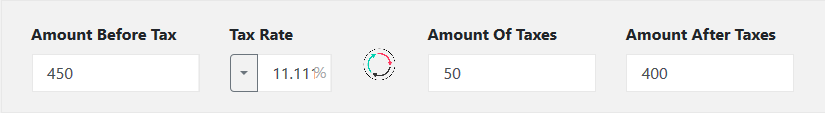

Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

. 1 2018 that rate decreased from 6875 to. Tax rate for all canadian remain. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a.

This app is especially useful to. Why A Reverse Sales Tax Calculator is Useful. Why A Reverse Sales Tax Calculator is Useful.

New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New. Reverse Sales Tax Formula. The second script is the reverse of the first.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property. The average cumulative sales tax rate in the state of New Jersey is 663.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022. Average Local State Sales Tax.

The most populous county. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. In the example above we have explained to you to calculate the Sales Tax amount.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Reverse Sales Tax Calculations. See the article.

If you know the total sales price and the sales tax percentage it will calculate the. Sales and Gross Receipts Taxes in New Jersey amounts to 163. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Current HST GST and PST rates table of 2022.

The next step is to multiply the outcome by the tax rate it will give you the total sales-tax. Reverse Sales Tax Calculator Of New Jersey For 2022. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

This takes into account the rates on the state level county level city level and special level. Here is how the total is calculated before sales tax. New Jersey has a 6625 statewide sales tax rate.

A Reverse Sales Tax Calculator is very useful for tax purpose because if you itemize your deductions and claim credit for the overpaid local and out-of-state sales taxes on. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Reverse Sales Tax Calculator Calculator Academy

Us Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator De Calculator Accounting Portal

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

State Corporate Income Tax Rates And Brackets Tax Foundation

Reverse Sales Tax Calculator 100 Free Calculators Io

Tip Sales Tax Calculator Salecalc Com

Reverse Sales Tax Calculator Calculator Academy

Best Practices For Sales Tax Display In The Checkout

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Recovery Reverse Sales Tax Audit Pmba